Credit issuers tend to profit handsomely from revolvers because the open-ended credit line means companies use them frequently and keep them in use for extended periods of time. The traditional drawdown approach compares the returns of only a single asset or portfolio. As a result, drawdown reflects only factual returns from a past period and has no direct predictive value, which other metrics, such as volatility, imply. A revolver lets an individual consumer or a business open a line of credit through a credit card or line of credit bank account, where the credit issuer offers a specified level of credit over time. Furthermore, the historical drawdown period is variable because it depends on the timing of the peak. The term revolver comes from revolving credit, a category of financing or borrowing. Low introductory rate offers and reward benefits make revolving credit lines attractive to consumers and small businesses.

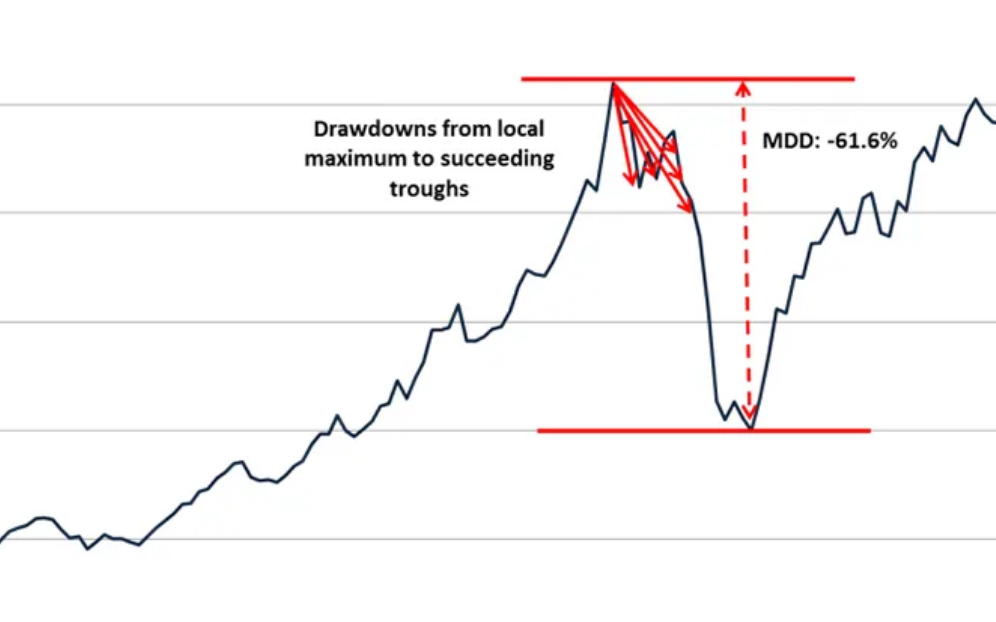

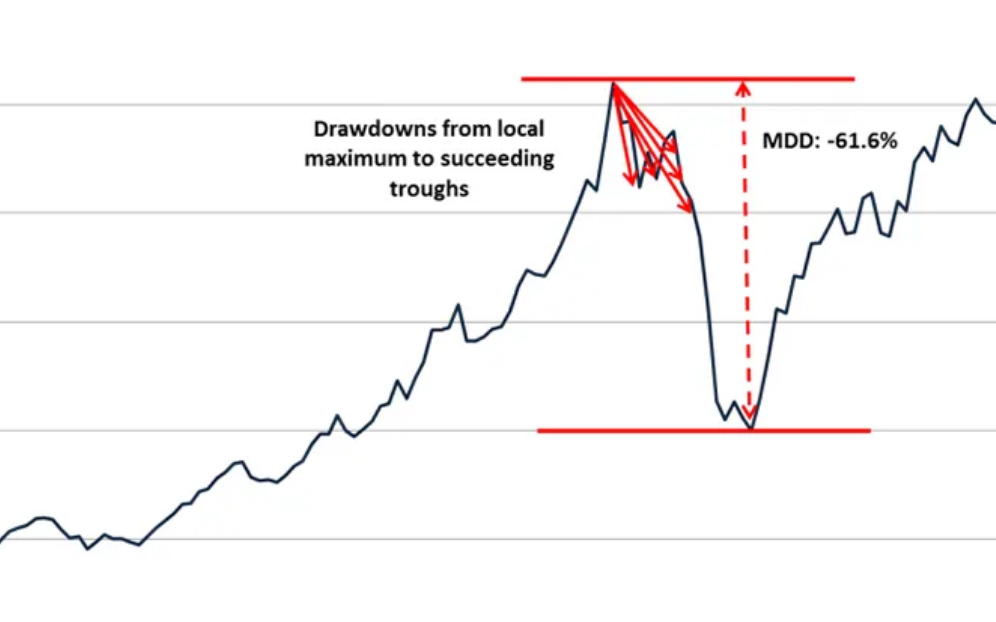

Non-revolving financing involves a loan whereby a one-time payout is issued to the borrower, who must, in turn, make fixed payments according to a schedule. The term derives from revolving credit, a type of financing that allows a borrower to maintain an open credit line up to a specified limit and make minimum monthly payments based on the balance and interest rate per the credit agreement. By slowly drawing down the debt, lenders can verify that funds are not misspent before providing more money. Non-revolving financing involves a loan whereby a one-time payout is issued to the borrower who. It is a measure that, especially in recent years, has become more popular in finance and risk management in particular. Tracking max drawdown in live trading helps you understand when your strategy might not be working as expected or you might be in a less than optimal mental state. Revolving financing allows the borrower to maintain an open credit line up to a specified limit. Drawdown is a risk measure used in asset management (mainly by hedge fund investors) to evaluate how long it typically takes an investment to recover from a temporary decline its net asset value. In backtesting, it shows you the downside risk of a strategy. Debt drawdown involves gradually issuing funds rather than releasing the entire amount at once. Maximum drawdown is an important trading statistic to track in your backtesting and live trading. According to philologist Garson O'Toole, the well known phrase is more likely to have originated from Joseph Chamberlain, who’s 1989 speech proclaimed: I think that you will all agree that we. A drawdown is the act of reducing a partys account by a specified amount.

Non-revolving financing involves a loan whereby a one-time payout is issued to the borrower, who must, in turn, make fixed payments according to a schedule. The term derives from revolving credit, a type of financing that allows a borrower to maintain an open credit line up to a specified limit and make minimum monthly payments based on the balance and interest rate per the credit agreement. By slowly drawing down the debt, lenders can verify that funds are not misspent before providing more money. Non-revolving financing involves a loan whereby a one-time payout is issued to the borrower who. It is a measure that, especially in recent years, has become more popular in finance and risk management in particular. Tracking max drawdown in live trading helps you understand when your strategy might not be working as expected or you might be in a less than optimal mental state. Revolving financing allows the borrower to maintain an open credit line up to a specified limit. Drawdown is a risk measure used in asset management (mainly by hedge fund investors) to evaluate how long it typically takes an investment to recover from a temporary decline its net asset value. In backtesting, it shows you the downside risk of a strategy. Debt drawdown involves gradually issuing funds rather than releasing the entire amount at once. Maximum drawdown is an important trading statistic to track in your backtesting and live trading. According to philologist Garson O'Toole, the well known phrase is more likely to have originated from Joseph Chamberlain, who’s 1989 speech proclaimed: I think that you will all agree that we. A drawdown is the act of reducing a partys account by a specified amount.

Drawdown finance free#

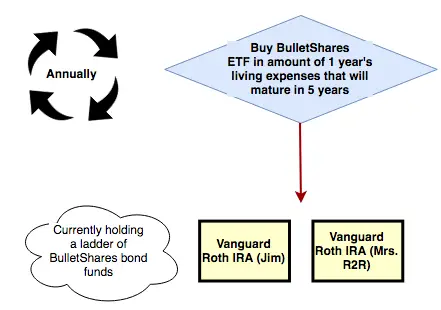

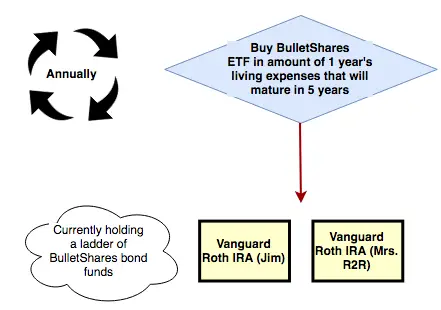

A revolver is a borrower, either an individual or a company, who carries a balance from month to month, via a revolving credit line. May you live in interesting times so says the apocryphal ‘Chinese curse’. The drawdown funds are invested in one or more funds with an aim of providing growth and to support income being taken. A drawdown enables you to make withdrawals from your pension fund while keeping the rest invested, allowing it to continue to grow, free from income tax and.

0 kommentar(er)

0 kommentar(er)